Estate Preparation Lawyer Offering Personalized Legal Solutions to Safeguard Your Legacy and Reduce Tax Obligation Effects

Are you looking for a trusted estate planning attorney to protect your legacy and reduce tax implications? Let us help you navigate the complexities of estate planning and protect your future.

The Significance of Estate Planning

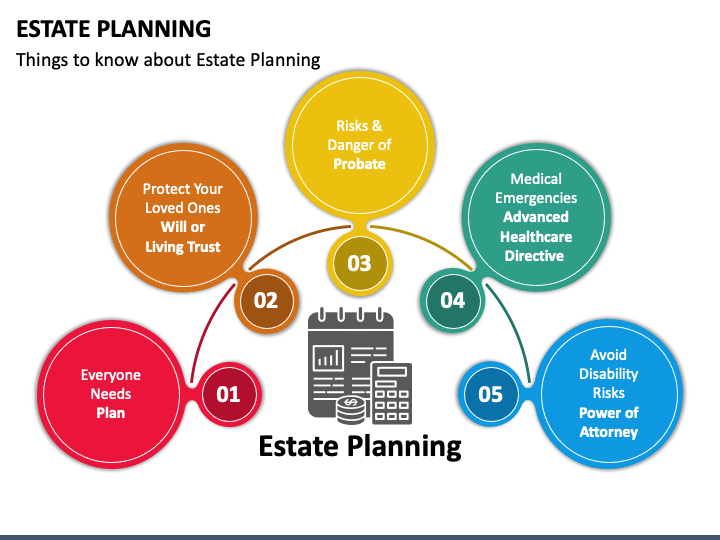

If you intend to safeguard your properties and make certain a smooth transfer of wide range to your loved ones, estate preparation is vital. By creating an extensive estate plan, you can have peace of mind recognizing that your wishes will be accomplished and your loved ones will be looked after after you are gone. Estate preparation includes making important choices regarding how your properties will certainly be distributed, that will certainly manage your events if you become incapacitated, and also who will certainly take care of your small kids if you pass away. Without an appropriate estate plan in area, your assets might be subject to probate, which can be pricey, lengthy, and might lead to your assets being dispersed in such a way that you did not plan. Furthermore, without an estate strategy, your loved ones might face unneeded concerns, such as disagreements over your assets and possible tax effects. By working with a skilled estate preparation attorney, you can guarantee that your wishes are adhered to, your liked ones are attended to, and your assets are secured. Do not wait till it's far too late-- start estate planning today to protect your legacy and minimize any possible issues that may emerge in the future.

Comprehending Tax Ramifications in Estate Planning

To completely secure your possessions and make sure a smooth transfer of riches to your liked ones, it is vital to recognize the tax ramifications associated with estate planning. Estate planning involves making important choices concerning exactly how your possessions will be distributed after your death, yet it additionally incorporates just how tax obligations will affect those distributions.

One essential tax consideration in estate preparation is the estate tax obligation. This tax is enforced on the transfer of residential property upon death and can dramatically lower the quantity of wide range that is passed on to your beneficiaries. Recognizing estate tax laws and policies can assist you lessen the effect of this tax and maximize the amount of wide range that your enjoyed ones will obtain.

An additional tax implication to consider is the resources gains tax. When certain possessions, such as supplies or property, are sold or moved, funding gains tax obligation might be applicable. By strategically intending your estate, you can make use of tax obligation exemptions and reductions to reduce the resources gains tax burden on your recipients.

Additionally, it is very important to understand the present tax obligation, which is troubled any presents you make during your life time. Mindful planning can aid you navigate the gift tax obligation policies and ensure that your presents are offered in the most tax-efficient method.

Strategies for Protecting Your Heritage

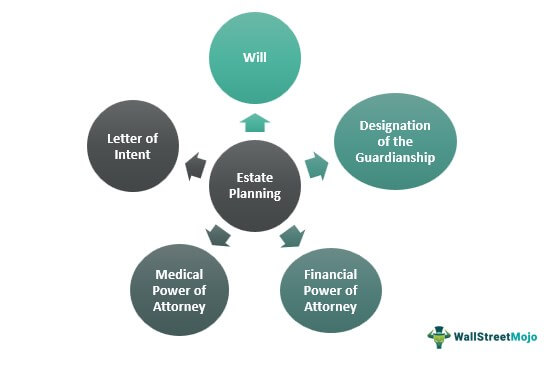

By partnering with a knowledgeable estate planning attorney, you can properly safeguard your tradition via individualized lawful strategies tailored to your certain demands. These strategies are developed to make certain that your assets are safeguarded and distributed according to your desires, while decreasing potential disputes and difficulties from beneficiaries or financial institutions. One key strategy is the development of a thorough estate strategy that consists of a will, trust fund, and powers of lawyer. A will certainly permits you to designate how your assets will be distributed upon your death, while a depend on can supply extra defense and control over the circulation of possessions. Powers of lawyer enable you to select a person you trust to make financial and healthcare choices on your part in the event of incapacity. Another important strategy is making use of gifting and charitable providing to reduce the dimension of your estate and decrease estate tax obligations. By gifting assets to loved ones or charitable companies throughout your life time, you can not only reduce your estate's taxed worth however likewise offer for your family and assistance creates that are crucial to you. Furthermore, establishing a family minimal collaboration or limited liability firm can assist safeguard your assets from possible financial institutions and offer the smooth transition of possession to future generations. Generally, dealing with a knowledgeable estate planning lawyer can supply you with the peace of mind recognizing that your heritage is secured and your wishes will be executed.

How an Estate Preparation Attorney Can Assist

One important method an estate preparation lawyer can help is by supplying customized lawful advice to guarantee that your possessions are protected and distributed according to your desires while decreasing possible disputes and challenges. Estate planning can be an intricate procedure, and having an attorney by your side can make all the difference.

Primarily, an estate preparation lawyer will listen to your particular objectives and worries. They will certainly site here take the time to understand your distinct scenarios and customize a strategy that fulfills your demands. This personalized approach guarantees that your desires are accurately shown in your estate strategy.

Additionally, an estate preparation lawyer will certainly have a deep understanding of the legal requirements and regulations bordering estate preparation. They will stay up to day with any kind of adjustments in the legislation that may affect your strategy - wills and trusts garden city ny. This proficiency allows them to make sure and navigate possible risks that your plan is legitimately audio

Additionally, an estate preparation attorney can help decrease tax obligation implications. They will certainly understand tax laws and approaches to aid you maximize your estate's value and lessen tax worries for your beneficiaries.

In the unfortunate occasion of disagreements or challenges to your estate strategy, an attorney can give the required assistance and depiction - elder lawyer garden city ny. They can aid settle disputes and shield your desires from being neglected

Personalized Lawful Solutions for Your Details Needs

Obtain tailored legal options to resolve your particular demands with the aid of an estate planning attorney. Estate preparation is a complex process that calls for mindful consideration of your special circumstances and objectives. An experienced lawyer can provide tailored support and develop an extensive strategy that safeguards your heritage and minimizes tax obligation implications.

An estate preparation lawyer will certainly put in the time to listen to your worries, comprehend your goals, and evaluate your present circumstance. They will certainly then establish a personalized plan that resolves your special scenarios. This may involve producing a will or count on, establishing powers of lawyer, marking recipients, or carrying out methods to lessen estate taxes.

By dealing with an estate preparation attorney, you can guarantee that your assets are dispersed according to your desires, your liked ones are attended to, and your tax obligation responsibility is lessened. They will browse the intricacies of estate legislation on your behalf and give you with comfort understanding that this article your legacy is shielded.

Don't leave your estate planning to opportunity. Seek advice from with an estate planning lawyer to get individualized legal solutions that are customized to your particular demands.

Final Thought

In verdict, hiring an estate preparation attorney is vital to protecting your legacy and decreasing tax obligation ramifications. Do not wait, get in touch with an estate planning attorney today to protect your future.

Are you looking for a relied on estate preparation lawyer to safeguard your heritage and reduce tax effects?One key tax consideration in estate planning is the estate tax obligation. An additional vital strategy is the use of gifting and charitable giving to reduce the size of your estate and reduce estate tax obligations.In addition, an estate preparation lawyer will certainly have a deep understanding of the lawful needs and regulations surrounding estate planning.In conclusion, hiring an estate planning lawyer is important to securing your tradition and lessening tax obligation ramifications.